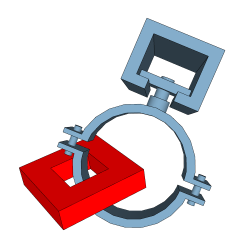

O型槽钢

- Product type: Libraries

- Product Code: MOUNT^O-Channel

plus VAT

“带配件、支架和管道支撑的 O 型槽钢” 库

O 型槽钢库包含多种组件,可用于设计二次结构和支撑钢结构模型。

库内容

-

O 型槽钢型材尺寸:

-

配件:

- 平板连接件。

- 90° 角连接件。

- 梁夹。

- 螺杆连接件。

- 端盖。

- 与 C 型槽钢的交叉连接件。

-

支架:

-

系统专用管道支撑:

使用时需要“3skeng Mount”工具。

有关更多详细信息,您可以 点击此处 访问包含库完整内容列表的数据表。

Related Products

Reverse Charge, VAT liability rests with the service recipient. (Autoliquidation)

Reverse Charge, VAT liability rests with the service recipient. (обратно начисляване)

Reverse Charge, VAT liability rests with the service recipient. (Omvendt betalingspligt)

Reverse Charge, VAT liability rests with the service recipient. (Pöördmaksustamine)

Reverse Charge, VAT liability rests with the service recipient. (Käännetty verovelvollisuus)

Reverse Charge, VAT liability rests with the service recipient. (Autoliquidation)

Reverse Charge, VAT liability rests with the service recipient. (Αντίστροφη επιβάρυνση)

Reverse Charge, VAT liability rests with the service recipient.

Reverse Charge, VAT liability rests with the service recipient. (Inversione contabile)

Reverse Charge, VAT liability rests with the service recipient. (Prijenos porezne obveze)

Reverse Charge, VAT liability rests with the service recipient. (Nodokļa apgrieztā maksā–ana)

Reverse Charge, VAT liability rests with the service recipient. (Atvirk–tinis apmokestinimas)

Reverse Charge, VAT liability rests with the service recipient. (Autoliquidation)

Reverse Charge, VAT liability rests with the service recipient. (Inverżjoni tal-ħlas)

Reverse Charge, VAT liability rests with the service recipient. (Btw verlegd)

Reverse Charge, VAT liability rests with the service recipient. (Steuerschuldnerschaft des Leistungsempfängers)

Reverse Charge, VAT liability rests with the service recipient. (Odwrotne obciążenie)

Reverse Charge, VAT liability rests with the service recipient. (Autoliquidação)

Reverse Charge, VAT liability rests with the service recipient. (Taxare inversă)

Reverse Charge, VAT liability rests with the service recipient. (Omvänd betalningsskyldighet)

Reverse Charge, VAT liability rests with the service recipient. (Prenesenie daňovej povinnosti)

Reverse Charge, VAT liability rests with the service recipient.

Reverse Charge, VAT liability rests with the service recipient. (Inversión del sujeto pasivo)

Reverse Charge, VAT liability rests with the service recipient. (Daň odvede zákazník)

Reverse Charge, VAT liability rests with the service recipient. (Fordított adózás)

Reverse Charge, VAT liability rests with the service recipient. (Αντίστροφη επιβάρυνση)

The service is not taxable in Germany. VAT liability, if applicable, rests with the service recipient.