3skeng 钢结构(PC/MAC)

- Product type: Tools

- Product Code: Steelwork

plus VAT

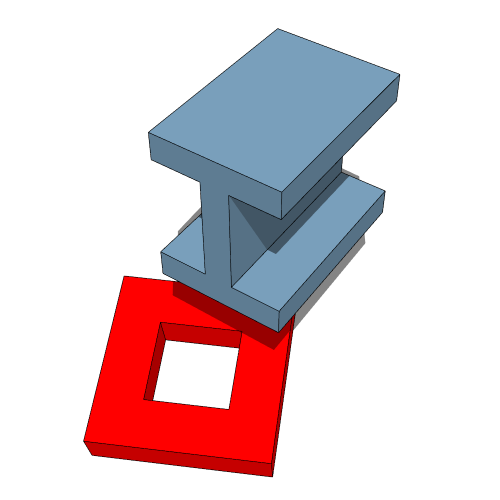

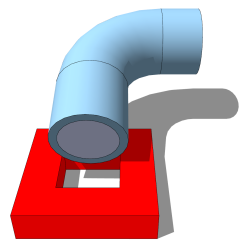

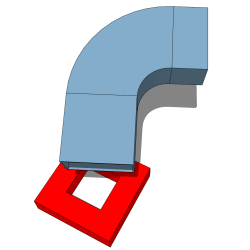

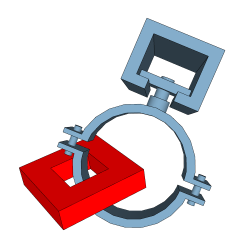

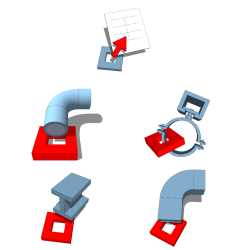

“3skeng 钢结构工具”提供了绘制带斜面或直线段钢结构模型所需的一切功能。各段可通过节点连接,内置丰富库文件,涵盖全球多种行业标准。

钢结构模型的受力分析

- 基于中心线设计桁架结构,并可借助 “3skeng List 工具” 分析模型质量(如“松散”连接)。

- 通过 “IFC 结构分析视图” 导出,您可在 BIM 流程中无损语义地传递设计的结构分析模型。

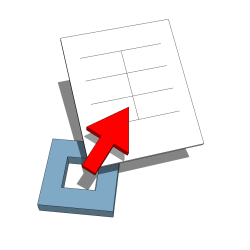

获取分析模型并控制质量

- 系统将从模型中的钢结构实体及其中心线、节点中派生出结构分析模型,并显示各部分的结构属性。

- 自动进行设计检查,任何与静力学不符的部分都会被高亮提示。您可即时检查、定位并修复结构设计中的问题。

开放 BIM 下的高效结构设计与互操作性

- 将 SketchUp 中的 3skeng 模型与结构分析软件对接。

- 借助开放文件格式 IFC,您可将“钢结构工具”生成的结构分析模型导出到任何支持 “IFC 结构分析视图” 的结构分析应用。

点击此处了解更多工具详情。

Related Products

Reverse Charge, VAT liability rests with the service recipient. (Autoliquidation)

Reverse Charge, VAT liability rests with the service recipient. (обратно начисляване)

Reverse Charge, VAT liability rests with the service recipient. (Omvendt betalingspligt)

Reverse Charge, VAT liability rests with the service recipient. (Pöördmaksustamine)

Reverse Charge, VAT liability rests with the service recipient. (Käännetty verovelvollisuus)

Reverse Charge, VAT liability rests with the service recipient. (Autoliquidation)

Reverse Charge, VAT liability rests with the service recipient. (Αντίστροφη επιβάρυνση)

Reverse Charge, VAT liability rests with the service recipient.

Reverse Charge, VAT liability rests with the service recipient. (Inversione contabile)

Reverse Charge, VAT liability rests with the service recipient. (Prijenos porezne obveze)

Reverse Charge, VAT liability rests with the service recipient. (Nodokļa apgrieztā maksā–ana)

Reverse Charge, VAT liability rests with the service recipient. (Atvirk–tinis apmokestinimas)

Reverse Charge, VAT liability rests with the service recipient. (Autoliquidation)

Reverse Charge, VAT liability rests with the service recipient. (Inverżjoni tal-ħlas)

Reverse Charge, VAT liability rests with the service recipient. (Btw verlegd)

Reverse Charge, VAT liability rests with the service recipient. (Steuerschuldnerschaft des Leistungsempfängers)

Reverse Charge, VAT liability rests with the service recipient. (Odwrotne obciążenie)

Reverse Charge, VAT liability rests with the service recipient. (Autoliquidação)

Reverse Charge, VAT liability rests with the service recipient. (Taxare inversă)

Reverse Charge, VAT liability rests with the service recipient. (Omvänd betalningsskyldighet)

Reverse Charge, VAT liability rests with the service recipient. (Prenesenie daňovej povinnosti)

Reverse Charge, VAT liability rests with the service recipient.

Reverse Charge, VAT liability rests with the service recipient. (Inversión del sujeto pasivo)

Reverse Charge, VAT liability rests with the service recipient. (Daň odvede zákazník)

Reverse Charge, VAT liability rests with the service recipient. (Fordított adózás)

Reverse Charge, VAT liability rests with the service recipient. (Αντίστροφη επιβάρυνση)

The service is not taxable in Germany. VAT liability, if applicable, rests with the service recipient.