3skeng 安装工具 (PC/MAC)

- Product type: Tools

- Product Code: Mount

plus VAT

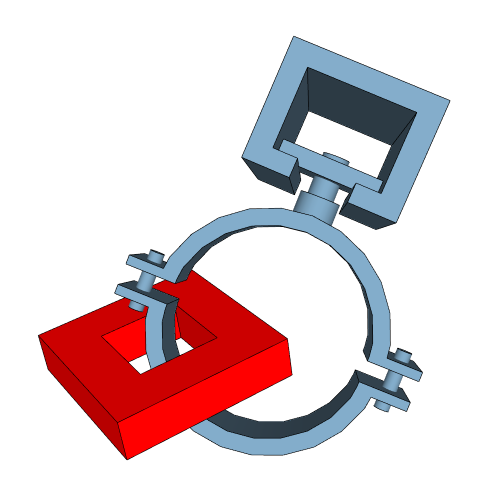

一款专为绘制次级/支撑钢结构模型而生的工具,集成了槽钢型材、配件、支架等库文件,让设计过程同 3skeng 系列其他工具一样简单直观。

核心功能

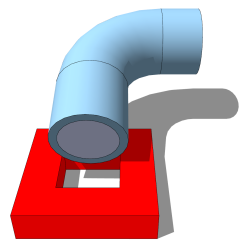

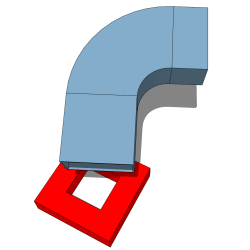

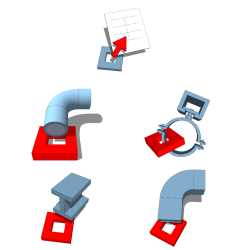

智能识别 Pipe Tool 元素

- a) 根据已有的管道与风管卡子自动筛选合适的配件

- b) 双击即可自动对齐旋转角度、位置和高度

智能识别 Steelwork Tool 元素

- a) 支架可自动连接到工字钢法兰顶面

- b) 钢梁卡可自动附着于工字钢法兰侧面

丰富配件库

提供滚珠轴承、管卡、管箍、管带、管托等多种支撑件,与管道和钢结构工具无缝配合,填补设计中对管道/风管支撑的空白,使您的设计得以真正落地。

设计辅助功能

Client(控制界面): 快速访问设置、材质与标准,上下文感知优化您的工作流程。

编辑与旋转: 轻松编辑并旋转 3skeng 元素。

连接: 快速连接并复制单个或多个 3skeng 元素。

标注: 便捷地为 3skeng 元素添加文本说明,清晰表达设计意图。

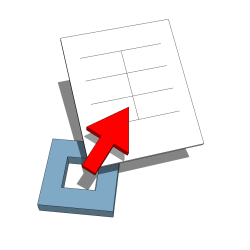

清单: 列出并汇总所选元素,复制内容即可生成物料清单(BOM)。

点击此处了解更多工具详情。

包含的两大库

"Threaded Rods and Pipe Clips" 库

系统独立的通用附加库,包含:

- 螺杆:M6 至 M20

- 连接件:丝接接头、风管阻尼器

- 管道与风管支撑:管卡、开口环风管支撑

点击此处下载完整库内容的数据表。

"C-Channel" 库

专为次级/支撑钢结构设计,包含:

- C 型槽钢:单槽/双槽,尺寸 41×25mm、41×41mm、41×62mm、41×83mm

- 配件:扁平接头、90° 角件、普通角件、翼型件、Z 型件、U 型件、梁卡、螺杆连接、端盖

- 支架:单/双槽基础座、悬臂单臂/双臂、竖直单/双支架

- 系统专用管道支撑:管箍、减振管箍、管带

点击此处下载完整库内容的数据表。

Related Products

Reverse Charge, VAT liability rests with the service recipient. (Autoliquidation)

Reverse Charge, VAT liability rests with the service recipient. (обратно начисляване)

Reverse Charge, VAT liability rests with the service recipient. (Omvendt betalingspligt)

Reverse Charge, VAT liability rests with the service recipient. (Pöördmaksustamine)

Reverse Charge, VAT liability rests with the service recipient. (Käännetty verovelvollisuus)

Reverse Charge, VAT liability rests with the service recipient. (Autoliquidation)

Reverse Charge, VAT liability rests with the service recipient. (Αντίστροφη επιβάρυνση)

Reverse Charge, VAT liability rests with the service recipient.

Reverse Charge, VAT liability rests with the service recipient. (Inversione contabile)

Reverse Charge, VAT liability rests with the service recipient. (Prijenos porezne obveze)

Reverse Charge, VAT liability rests with the service recipient. (Nodokļa apgrieztā maksā–ana)

Reverse Charge, VAT liability rests with the service recipient. (Atvirk–tinis apmokestinimas)

Reverse Charge, VAT liability rests with the service recipient. (Autoliquidation)

Reverse Charge, VAT liability rests with the service recipient. (Inverżjoni tal-ħlas)

Reverse Charge, VAT liability rests with the service recipient. (Btw verlegd)

Reverse Charge, VAT liability rests with the service recipient. (Steuerschuldnerschaft des Leistungsempfängers)

Reverse Charge, VAT liability rests with the service recipient. (Odwrotne obciążenie)

Reverse Charge, VAT liability rests with the service recipient. (Autoliquidação)

Reverse Charge, VAT liability rests with the service recipient. (Taxare inversă)

Reverse Charge, VAT liability rests with the service recipient. (Omvänd betalningsskyldighet)

Reverse Charge, VAT liability rests with the service recipient. (Prenesenie daňovej povinnosti)

Reverse Charge, VAT liability rests with the service recipient.

Reverse Charge, VAT liability rests with the service recipient. (Inversión del sujeto pasivo)

Reverse Charge, VAT liability rests with the service recipient. (Daň odvede zákazník)

Reverse Charge, VAT liability rests with the service recipient. (Fordított adózás)

Reverse Charge, VAT liability rests with the service recipient. (Αντίστροφη επιβάρυνση)

The service is not taxable in Germany. VAT liability, if applicable, rests with the service recipient.