3skeng 列表工具 (PC/MAC)

- Product type: Tools

- Product Code: List

plus VAT

“3skeng 列表工具 工具”为 SketchUp 添加了电子表格功能!这一全新扩展可让您在基于数据的视图中交互并操作 SketchUp 实体。可对实体进行列出、筛选、排序和批量编辑,轻松生成物料清单、零件列表或报告,并导出为 Excel(.XLSX)格式。

使用 “3skeng List” 提升效率

- 强大互动式筛选与排序

即便在大型模型中,也能快速筛选、排序并批量编辑属性,完成复杂或大规模的选择。

- 同步的电子表格与三维模型

在 “3skeng List” 中修改数据(如坐标或名称)会即时反映到 SketchUp 模型中,反之亦然!

- 子集选择高亮显示

在三维视图中交互式高亮选中子集,帮助您直观检查与确认。

“3skeng List” 助力模型清洁

- 检测并清理重复实体

- 批量将多个群组转换为组件

- 在选中组件间快速替换

- 按所需精度四舍五入坐标

一份清晰、干净的模型是高质量成果的基础。.

导出元数据

- 格式化导出:所有表格视图均可导出为 Excel(.xlsx)文件,或复制为纯文本。

- 自定义数据列:可通过在定义、实例、图层或材质名称中使用“^”作为分隔符,为组件添加自定义数据列。

- 保存视图设置:将筛选与列配置保存在自定义列表视图中,便于重复使用。

小贴士: 将导出的 Excel 表格与预先设计的模板或 Trimble Layout 结合,可实现快速、可靠的报表生成流程!

卓越成果的必备利器

强大的选择方式、近乎无限的排序与编辑可能性,以及成熟的报表选项,使得 “3skeng List” 成为追求卓越 SketchUp 模型的专业人士的得力助手。

点击此处了解更多工具详情。

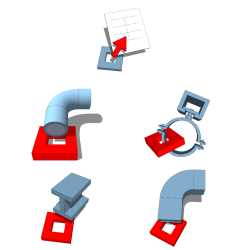

Related Products

Reverse Charge, VAT liability rests with the service recipient. (Autoliquidation)

Reverse Charge, VAT liability rests with the service recipient. (обратно начисляване)

Reverse Charge, VAT liability rests with the service recipient. (Omvendt betalingspligt)

Reverse Charge, VAT liability rests with the service recipient. (Pöördmaksustamine)

Reverse Charge, VAT liability rests with the service recipient. (Käännetty verovelvollisuus)

Reverse Charge, VAT liability rests with the service recipient. (Autoliquidation)

Reverse Charge, VAT liability rests with the service recipient. (Αντίστροφη επιβάρυνση)

Reverse Charge, VAT liability rests with the service recipient.

Reverse Charge, VAT liability rests with the service recipient. (Inversione contabile)

Reverse Charge, VAT liability rests with the service recipient. (Prijenos porezne obveze)

Reverse Charge, VAT liability rests with the service recipient. (Nodokļa apgrieztā maksā–ana)

Reverse Charge, VAT liability rests with the service recipient. (Atvirk–tinis apmokestinimas)

Reverse Charge, VAT liability rests with the service recipient. (Autoliquidation)

Reverse Charge, VAT liability rests with the service recipient. (Inverżjoni tal-ħlas)

Reverse Charge, VAT liability rests with the service recipient. (Btw verlegd)

Reverse Charge, VAT liability rests with the service recipient. (Steuerschuldnerschaft des Leistungsempfängers)

Reverse Charge, VAT liability rests with the service recipient. (Odwrotne obciążenie)

Reverse Charge, VAT liability rests with the service recipient. (Autoliquidação)

Reverse Charge, VAT liability rests with the service recipient. (Taxare inversă)

Reverse Charge, VAT liability rests with the service recipient. (Omvänd betalningsskyldighet)

Reverse Charge, VAT liability rests with the service recipient. (Prenesenie daňovej povinnosti)

Reverse Charge, VAT liability rests with the service recipient.

Reverse Charge, VAT liability rests with the service recipient. (Inversión del sujeto pasivo)

Reverse Charge, VAT liability rests with the service recipient. (Daň odvede zákazník)

Reverse Charge, VAT liability rests with the service recipient. (Fordított adózás)

Reverse Charge, VAT liability rests with the service recipient. (Αντίστροφη επιβάρυνση)

The service is not taxable in Germany. VAT liability, if applicable, rests with the service recipient.